Plate IQ, a San Francisco-based technology company that helps restaurants improve and automate their invoice and back-of house processes, analyzed more thab 800,000 invoices per month from January through December of last year. This included six million data points per month. By examining this, data Plate IQ was able to determine the food trends that shaped the food industry for the year.

President Donald Trump’s trade wars resulted in domestic over-supply of many ingredients, causing a significant dip in soy bean prices starting in August, dropping 7.5 percent. The price drop appears to have been short-term in nature as soy bean prices began to recover starting in late November 2018.

Despite the drop in price, demand remained relatively consistent throughout 2018

Cauliflower fluctuated significantly in price throughout the year from a low of 24 cents per pound to as high as 47 cents per pound, primarily due to the vegetable’s rising popularity as an alternative to starchy carbs and ingredient in trendy diets including the Keto and Paleo diets. These trends led restaurants to invest heavily in cauliflower LTOs in 2018, testing substitutes such as mashed cauliflower, cauliflower rice and other innovative form factors.

Overall foodservice demand for cauliflower grew by 18 percent in 2018, indicating its longer-term growth potential.

E. Coli and foodborne illness concerns decimated the price of, and demand for, Romaine lettuce in 2018. Sales of Romaine plummeted more than 44 percent in May alone following the CDC’s announcement of an E. Coli outbreak that left five dead and more than 200 sick. Prices and demand remained depressed through Q3 and into Q4, with Romaine showing signs of a recovery beginning in December.

The drop in demand significantly benefitted other types of lettuce as operators quickly replaced Romaine with varieties including Iceberg and Boston. Prices of Iceberg lettuce soared by nearly 107 percent during the E. Coli scare.

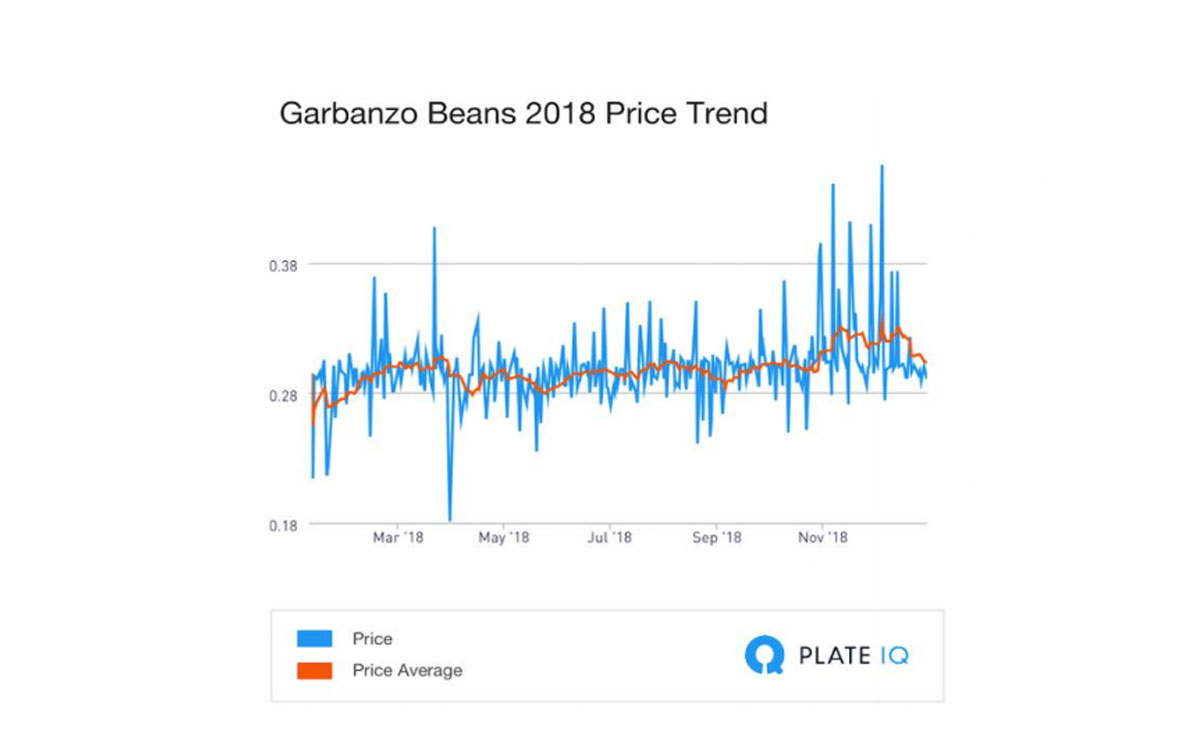

Garbanzo beans have been on the rise as a food trend since 2016 as the legume has become a central ingredient in vegan diets.

Overall demand steadily increased again in 2018, growing by 36 percent in quantity purchased per restaurant.

Cold Brew hit the scene a few years ago but saw explosive growth in restaurants during 2018, especially during the summer months, with demand increasing 200 percent year-over-year.

The growth was largely due to restaurants beginning to respond to consumers increasingly desire for the smoother, less acidic taste by featuring cold-brew on their menus in creative ways such as lattes and cold-brew infused milkshakes.

With more and more individuals becoming more conscious of their alcohol intake, each year shows adaption of better eating and drinking habits. Alcohols such as Vodka were predicted to drop in popularity in 2018 but remained steady, however the price of vodka fluctuated throughout the year.

Trumps’ trade wars also caused increased cost for distilleries due to tariffs imposed on grains and importing/exporting costs.

2018 saw the year of increased sales in beverages that were in general fizzy with added ingredients such as vitamins and electrolytes rising 17.5 percent in sales.

Kombucha being the healthier alternative to alcohol has also caught on in the market as an alternative, being served as alcoholic and non-alcoholic versions.